Profit for the year was $4,500 and retained earnings at 31 December 20X1 are $7,000. Cash Flow From Operating Activities is one of the categories of cash flow. The company’s current assets and current liabilities on 31 March 2019 are shown below. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

Create a Free Account and Ask Any Financial Question

Solution (b) indirect methodAs we start with profit before tax in the indirect method, we have to add back all the non-cash expenses charged, deduct the non-cash income and adjust for the changes in working capital. Only then are the two actual cash flows of interest paid and tax paid presented. Having a good understanding of the format of the statement of cash flows is key to a successful attempt at these questions. Under the indirect method, cash flow from operating activities is calculated by first taking the net income from a company’s income statement. Because a company’s income statement is prepared on an accrual basis, revenue is only recognized when it is earned and not when it is received.

Get in Touch With a Financial Advisor

Under both of these methods the interest paid and taxation paid are then presented as cash outflows deducted from the cash generated from operations. Alternatively, the indirect method starts with profit before tax rather than a cash receipt. The profit before tax is then reconciled to the cash that it has generated. This means that the figures at the start of the cash flow statement are not cash flows at all. The changes in inventory, trade receivables and trade payables (working capital) do not impact on the measurement profit but these changes will have impacted on cash and so further adjustments are made.

How does DPO relate to other financial metrics?

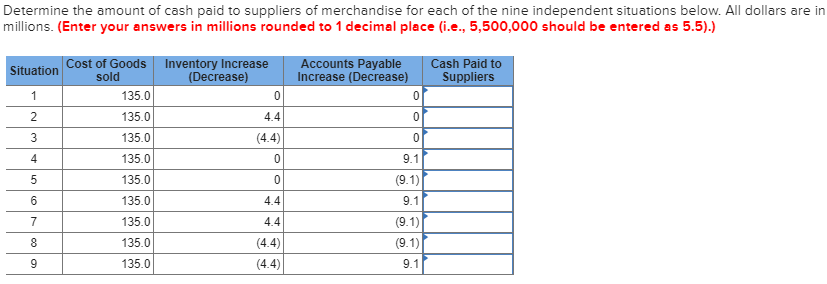

The accrual-based interest expense figure can be taken from the income statement, and the increase or decrease in interest payable liability can be obtained by analyzing the comparative balance sheet of the company. The indirect method also makes adjustments to add back non-operating activities that do not affect a company’s operating cash flow. Cash paid to suppliers refers to the actual cash outflow a business incurs when purchasing goods or services necessary for its trade discount definition operations. This transaction is crucial as it directly impacts the company’s operating cash flows, which are essential for maintaining liquidity and funding ongoing business activities. Understanding how cash paid to suppliers fits into operating cash flows helps assess a company’s efficiency in managing its cash resources while maintaining relationships with vendors. In the formulas given above, it is assumed that accounts receivable are only used for credit sales.

Is it better to have a high or low Days Payable Outstanding?

The direct method adds up all the various types of cash payments and receipts, including cash paid to suppliers, cash receipts from customers and cash paid out in salaries. These figures are calculated by using the beginning and ending balances of a variety of business accounts and examining the net decrease or increase of the account. As previously mentioned, the net cash flows for all sections ofthe statement of cash flows are identical when using the directmethod or the indirect method. The difference is just in the waythat net cash flows from operating activities are calculated andpresented. The direct approach requires that each item of incomeand expense be converted from the accrual basis value to the cashbasis value for that item. This is accomplished by adjusting theaccrual amount for the revenue or expense by any related currentoperating asset or liability.

- The dividend income is received in cash, and there was no dividend receivable at the beginning or at the end of the year.

- Profit for the year was $4,500 and retained earnings at 31 December 20X1 are $7,000.

- Additional informationDuring the year, depreciation of $50,000 and amortisation of $40,000 was charged to the statement of profit or loss.

- These figures are calculated by using the beginning and ending balances of a variety of business accounts and examining the net decrease or increase of the account.

- In other words, it lists where the cash inflows came from, usually customers, and where the cash outflows went, typically employees, vendors, etc.

Why You Can Trust Finance Strategists

However, the cash flows relating to such transactions are cash flows from investing activities. Note that the cash proceeds ffrom the disposal of PPE ($20) would be shown separately as a cash inflow under investing activities. The profit on disposal of $5 ($20–$15) would be adjusted for as a non-cash item under the operating activities (see later). Solution Here we can take the opening balance of PPE and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash flows. The income statement of ABC Company for the year 2023 shows an interest income of $5,000 and a dividend income of $3,200. The balance in the interest receivable account at the beginning and end of 2023 is $1,000 and $1,200, respectively.

In other words, it lists where the cash inflows came from, usually customers, and where the cash outflows went, typically employees, vendors, etc. The cash flow from operating activities is one part of the direct method cash flow statement which also includes cash flows from investing and financing activities. An example format for a direct method cash flow statement is shown below. Still, whether you use the direct or indirect method for calculating cash from operations, the same result will be produced.

In contrast, cash flow from operating activities will decrease when there is an increase in prepaid expenses. Operating cash flow can be found in the cash flow statement, which reports the changes in cash compared to its static counterparts—the income statement, balance sheet, and shareholders’ equity statement. Also known as the cash flow from operations (CFO), it specifically reports where cash is used and generated over specific time periods, tying the static statements together. The problem with this method is it’s difficult and time consuming to create. Most companies don’t record and store accounting and transactional information by customer, supplier, or vendor.