The retainer item can now be selected when creating an invoice or sales receipt for a deposit or retainer payment. It is a difficult balancing act to keep expenses in line with money received by customers. Collecting outstanding amounts due from customers is never a pleasant task, but it is an essential one. If overdue amounts get out of hand, they can cause serious cash-flow problems for your business.

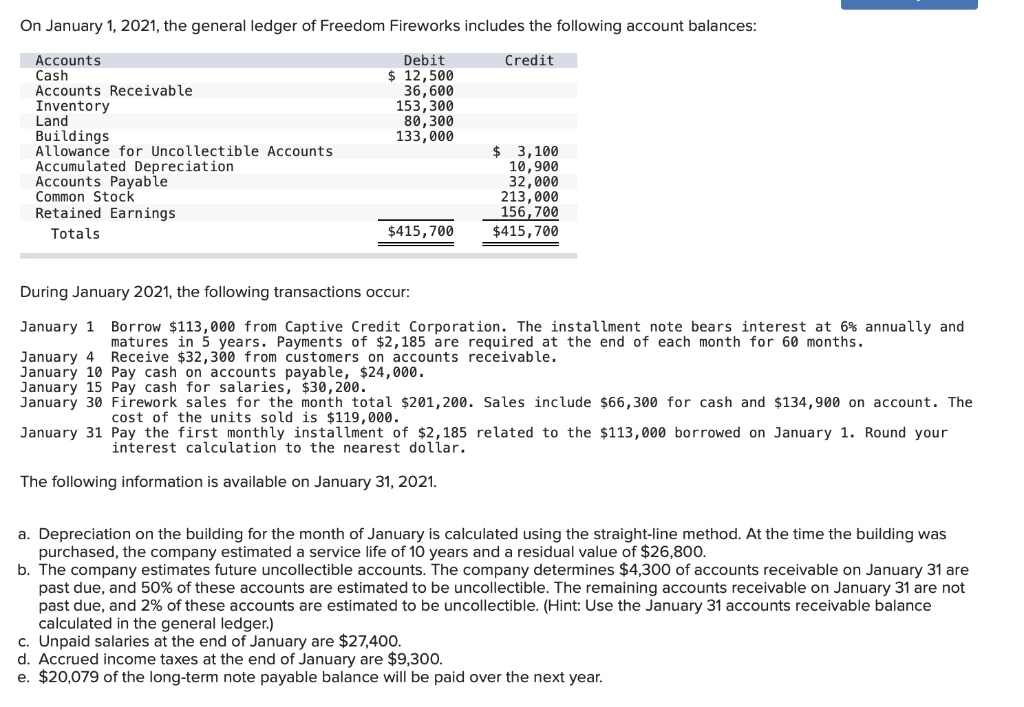

Accounting Equation for Account Receivable Collection Entry

Credit The credit entry to the service revenue account records the revenue earned as a result of providing the service. Once you have set up the accounts and the retainer or deposit item, you can begin to create Sales receipts for the deposits or retainers you receive. 5 5 cost-volume-profit analysis in planning managerial accounting First, you need to create a liability account to track the amount of the retainers you receive from your customers. Checking a customer’s credit rating will mitigate the risk of not getting paid. Offering credit terms is always risky, especially for a small business.

Create the cash received entry

Again, you must record a debit in your cash receipts journal and a credit in your sales journal. The benefits of using accounts receivable generally outweigh the risks for businesses that can afford to absorb the potential nonpayment by one or more clients. These benefits include being able to assess the accounts as positive assets, in addition to liquid assets. Being able to offer services or goods immediately and receive payment at the customer’s convenience allows your company to garner customers quickly. If you lose one or more cash sales receipts, it may be difficult to have an accurate balance sheet because the cash account will be incorrect. An inaccurate balance sheet can lead to underestimation of business expenses and inflation of profit and revenue.

Journal Entry for Receiving Cash for Service

Customers who owe your business money are referred to as ‘debtors’ and an account receivable is created for each of them. Managing debtors can be a full-time task and for many small businesses, the process needs to be managed on a daily basis. It is a good idea to send out reminders in advance of the payment due date. Customers may overlook an invoice, or they may have cash-flow problems of their own. Because cash is such a vital asset to all businesses, you need to do everything possible to make sure your customers pay on time. It is a measure of the money that a business brings in from its activities which is the selling of goods or services.

- A check is placed under the total of this column as this total is net posted.

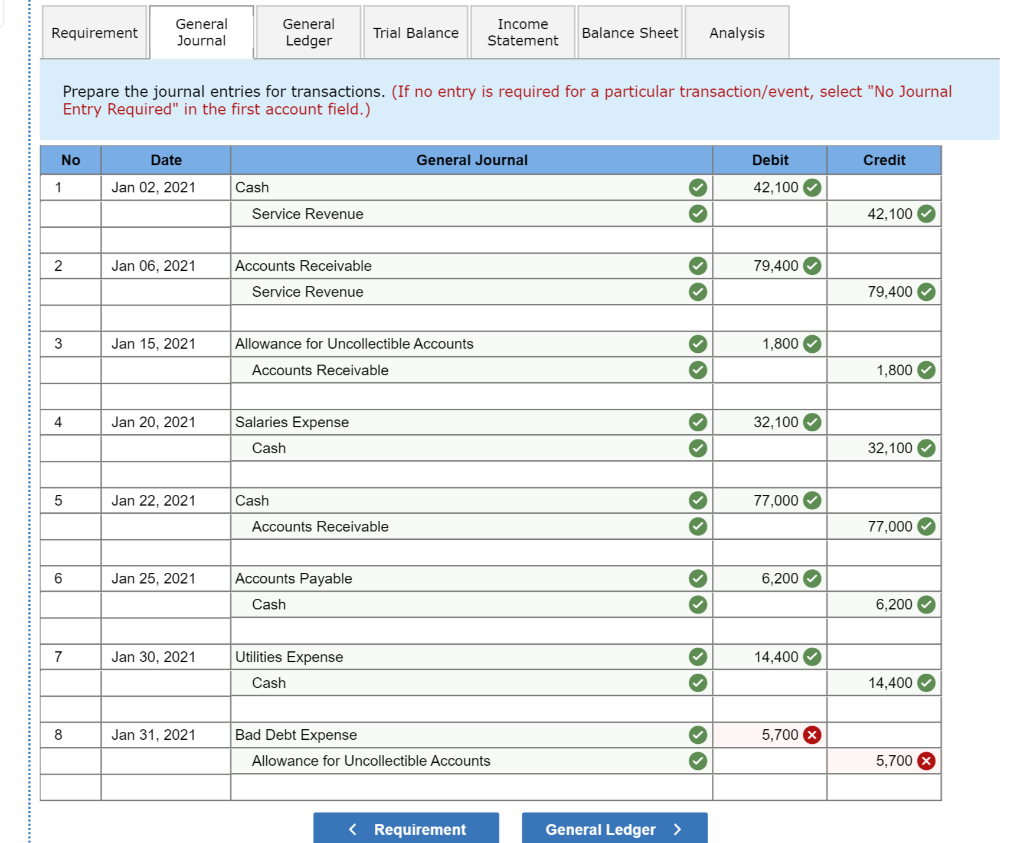

- The accounts receivable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable.

- This is the fundamental principle of any business, and it is how companies generate revenue and expand their operation.

- As these accounts are posted, the account number is entered into the post reference column.

- When you invoice the customer and receive payment against it, you’ll turn that liability into income.

A company that receives cash on an account, which is known as a debit, applies that cash to pay down the account receivable. Payments out of an account or services rendered before payment are considered credits. The journal entry is increasing the cash balance on the balance sheet. The journal entry is debiting cash received and credit sales revenue. This is the fundamental principle of any business, and it is how companies generate revenue and expand their operation. There are many different ways to sell goods or services, but the most common method is through some form of marketing.

Double-check they still hold the right account details for you – if you’ve swapped banks since you were a student this may be out of date – and then click submit. The watchdog has previously reported a 25% increase in prices over the past two years, with just two companies, Nestle and Danone, controlling 85% of the market. “We intend to offset all of it using the multiple levers we always do when hit with surprises like that… of course, we’ll be looking at the price of products and services,” said chief executive Alison Kirkby. Asda is the latest supermarket to warn of potential price rises, claiming tax changes revealed in the budget will incur £100m in extra costs.

This could be useful if the operating costs for that account were low enough, as you can claim the owed value as a business loss, which lowers your taxes. A miscellaneous cash receipt is for cash not received in the ordinary course of daily business. Examples would be the proceeds for loan payments, money for increased capital investment, and refunds from vendors. An invoice is a request for payment after goods or services have been exchanged. A cash receipt, on the other hand, is the record that says payment has been received for goods or services and the receipt is the proof of purchase for the buyer. Depending on a company’s requirements, different formats are used for a cash receipts journal.

And when you collect money from a customer, you need to record the transaction and reflect the sale on your balance sheet. When you collect money from a customer, the cash increases (debits) your balance sheet. For example, suppose a business provides design services and has received cash of 4,000 from a customer. The cash receipt needs to be credited to the customers accounts receivable account. A cash advance received from customer journal entry is required when a business receives a cash payment from a customer in advance of delivering goods or services.

The journal entry is debiting cash $ 5,000 and credit service revenue $ 5,000. In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative. For a fuller explanation of journal entries, view our examples section. Your cash receipts journal manages all cash inflows for your business. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

But what is all too frequent are the barriers women face when working in professional kitchens. Only 17% of chefs in the UK are women – and those who do break into the industry face sexism, abuse and male dominance. From name-calling to an “accident” with scalding oil, five top female chefs tell Money about life at the pass.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. The service is provided to the customer and payment from the customer is immediate using cash.